Your Local 1500 is pleased to offer our valuable members

the following supplemental benefits choices:

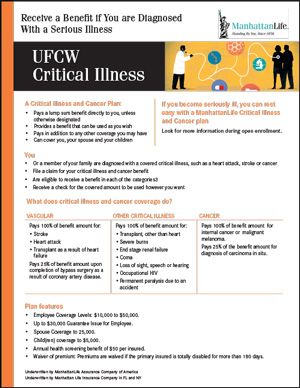

Critical Illness Insurance

Critical Illness Insurance from Manhattan Life helps protect families and their assets when employees are most vulnerable: during the working years.

Critical Illness Insurance pays a lump-sum benefit following the diagnosis of a critical illness, such as a heart attack or stroke. The plan also pays in the case of a reoccurrence of the same critical illness or an occurrence of a different critical illness, up to the maximum payment.

Benefit payments can be used for whatever you want, such as out-of-pocket medical care costs, home healthcare, travel to and from treatment facilities, rehabilitation, and other expenses.

- Includes a $50 Wellness benefit payment for covered yearly checkups – payable every year!

- Pays in coordination with any other insurance you may have.

- Low-cost affordable rates!

- Direct payment to you.

Important Covid-19 Information:

Critical Illness Insurance covers three main areas; Cancer, Vascular, and Other Critical Illnesses. Unless COVID-19 lead to one of the specifically denoted Critical Illnesses, outlined in the plan documents, there would be no benefit payable under this plan. Heart attacks are covered in the Critical Illness plan, but cardiac arrest (when the heart stops beating unexpectedly) is not covered on the plan.

Call 844-808-8009 to enroll.

Our multi-language professionals are available 24/7 to answer all of your benefits and services questions.

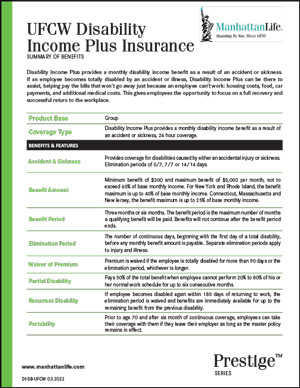

Disability Insurance

Most people can’t afford to be disabled, even for a short time. Almost 90 percent of disabling accidents and illnesses are not work related, so you can’t count on Workers Compensation to be there for you and your loved ones.

The Disability Income Plus from Manhattan Life is designed to help provide you with a monthly income benefit for the time period you select (3 or 6 months) as you recover. This plan supplements lost wages due to a covered injury or illness.

You'll receive a monthly payment that you can spend however you wish — to help cover everyday expenses, medical costs, or whatever you want!

1. Waiver of Premium. If an employee becomes disabled again within 180 days of returning to work, the elimination period is waived, and benefits are immediately available for up to the remaining benefit from the previous disability.

2. Pays in coordination with any existing disability coverage you may have.

3. Direct payment to you.

ManhattanLife will follow Disability policy language outlined below as it relates to COVID-19 until further notice.

Disability Benefits

Disability benefits apply for an Accident/Sickness only and therefore a person diagnosed with COVID-19 would be covered under their disability plan.

A person that fits into any of the following categories would NOT be covered under their ManhattanLife disability plan:

• If you are asked to-self quarantine but are not sick.

• If your employer needs to shut down due to an employee contracting COVID-19 and have been asked to isolate or quarantine as a result.

Disability Policy Language

Totally Disabled: (Total Disability) means, for the first 24 months of a disability that the Employee is:

• unable to perform the substantial and material duties of His Regular Occupation;

• not working in any other occupation; and

• under the care of a Physician for the disability.

• Sickness: an illness, disease or complication of pregnancy that first makes itself known after the Effective Date and while this Policy is in force.

• Elimination Period: The policies elimination period would apply. If the policy has a 14-day elimination period, disability benefits would not start until the 15th day.

•Note: Elimination periods will not be waived due to COVID-19

Limitations and Exclusions

Benefits are not payable for losses contributed to or caused by:

• the Employee’s employment;

• Sickness or Injury for which Benefits are paid or payable under any Workers’ Compensation or occupational disease law;

Websites with additional information regarding COVID-19

• The Centers for Disease Control (CDC) Website: https://www.cdc.gov/coronavirus/2019-ncov/index.html

• Some states are addressing questions surrounding unemployment for workers and businesses due to COVID-19.

See Washington’s Q&A link here: https://esd.wa.gov/newsroom/covid-19

Call 844-808-8009 to enroll.

Our multi-language professionals are available 24/7 to answer all of your benefits and services questions.

Whole Life Insurance

A Whole Life policy from ManhattanLife lets you plan for the future while getting real benefits for today!

- Cash value. A Whole Life plan can build cash value, that you can have access to, for things such as mortgage costs, a child’s education expenses, retirement income and more

- Portability. Whole Life is lifelong coverage (as long as premiums are paid) that you can take with you, even when you retire or go to a new company.

- Premiums that never go up.

While you may have a basic Term Life plan during your working years, it may not be enough to provide the level of coverage your family needs in the later years, even to age 99. Whole Life can help. It provides coverage through retirement with premiums and benefits that don’t change with age.

Important Covid-19 Information

If a member passes away, regardless as to whether it is due to COVID or any other illness/injury,

a death benefit is paid under this plan for the amount of coverage inforce at the time of death.

Call 844-808-8009 to enroll.

Our multi-language professionals are available 24/7 to answer all of your benefits and services questions.

Accident Insurance

Group Accident Insurance from Manhattan Life provides cash benefits for medical treatment received for covered accidents, injuries, ambulance services, hospitalization, or accidental death. The plan pays regardless of what your primary insurance covers with no coordination of benefits.

The benefit is paid directly to you and can be used for whatever you want. Help cover unexpected out-of-pocket expenses while you recover - deductibles, co-pays, childcare, and even non-medical expenses.

Group Accident Insurance includes these additional riders at NO COST to you!

- $50 Wellness benefit payment for covered yearly checkups - every year!

- Youth Organized Sports Rider included at NO COST! Extra protection for non-professional sports injuries, such as club sports.

- On The Job Insurance (24 Hour Insurance) Benefit

Important Covid-19 Information:

Accident Insurance will not be impacted by COVID-19 as this product reimburses for accidents from injury and not sickness.

Call 844-808-8009 to enroll.

Our multi-language professionals are available 24/7 to answer all of your benefits and services questions.

Hospital Indemnity Insurance

The Hospital Indemnity plan from Manhattan Life pays cash benefits from day one when you are hospitalized or receive other covered medical treatment. The plan supplements your primary medical coverage by filling the potential gaps created by rising deductibles, co-payments, and out-of-pocket expenses not covered by your health plan.

Benefits can be paid directly to you or your medical service provider regardless of what your primary insurance covers - there is no coordination of benefits. You have the freedom to use the cash benefits as needed; to cover medical bills, everyday living expenses, or other unexpected out-of-pocket expenses.

1. Wellness benefit. Receive a $50 payment for covered yearly checkups - every year!

2. Guaranteed acceptance up to age 90 – no medical questions!

3. Waiver of Premium rider included. Premiums are waived if the primary insured is totally disabled for more than 180 days.

Call 844-808-8009 to enroll.

Our multi-language professionals are available 24/7 to answer all of your benefits and services questions.

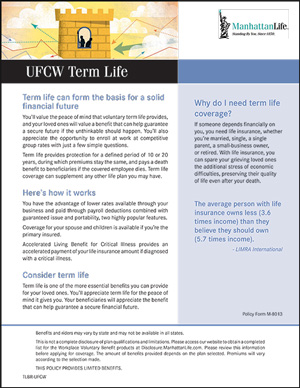

Term Life

If someone depends financially on you, you need life insurance, whether you are married, single, a single parent, a small business owner, or retired. With Term life insurance from Manhattan Life, you can spare your grieving loved ones the added stress of economic difficulties, preserving their quality of life even after your death.

You will also appreciate the opportunity to enroll at work at competitive group rates with just a few simple questions. Term Life provides protection for a defined period of time, during which premiums stay the same, and pays a death benefit to beneficiaries if the covered employee dies. Term Life coverage can supplement any other life plan you may have.

1. Lower rates. You have the advantage of lower rates available through your employer and paid through payroll deductions combined with guaranteed issue and portability, two highly popular features. Coverage for your spouse and children is available if you’re the primary insured.

2. Accelerated Living Benefit: Value while you're alive. You can request an acceleration payment of up to 50 percent of the death benefit if diagnosed with a terminal illness in the future.

3. Portability. Even if you retire or change jobs, you can take the policy with you. You own it (as long as premiums are paid).

Call 844-808-8009 to enroll.

Our multi-language professionals are available 24/7 to answer all of your benefits and services questions.